The Ultimate Personal Finance System in Coda

Original walkthrough video

2024 updates to the system

Money, when you have enough of it, becomes a “psychological” hindrance, rather than a practical one. Listen to the I Will Teach You To Be Rich podcast episodes, and you will find enough content to make you introspect and reflect on your own psychological relationship with money. Morgan Housel puts money into context in his book “The Psychology of Money”, where he breaks down a framework for a financial mindset and living a life of healthy abundance instead of restrictive scarcity.

The Coda Personal Finance Tracker is a comprehensive system to keep track of your wealth, budget, record transactions, review dynamic charts, and minimize the friction of data entry. Paying attention—in the light sense of the concept—to your financial life is as important as any area of your life, one could argue. Similar to tracking calories and training sessions when you are on a diet or simply want to optimize your well-being, tracking your expenses, income, and overall wealth can offer insights into reality as is, not as you wish it to be.

The Coda finance tracking system is complex in the background but easy to use on a daily basis. Interactive buttons and advanced formulas make data entry minimal, so you can easily fit it into your schedule. This encourages sustainable use of the system, as it reduces friction and makes it easier to find the time to enter your transactions.

The Coda personal finance tracker has a workflow onboarding page that guides you through the complete initial setup and customization of your system. There are three fundamental features in the system:

Monthly review and budgeting

Recording transactions (income and expenses) and categorizing them

Visualizing all your data in charts by month, quarter, year

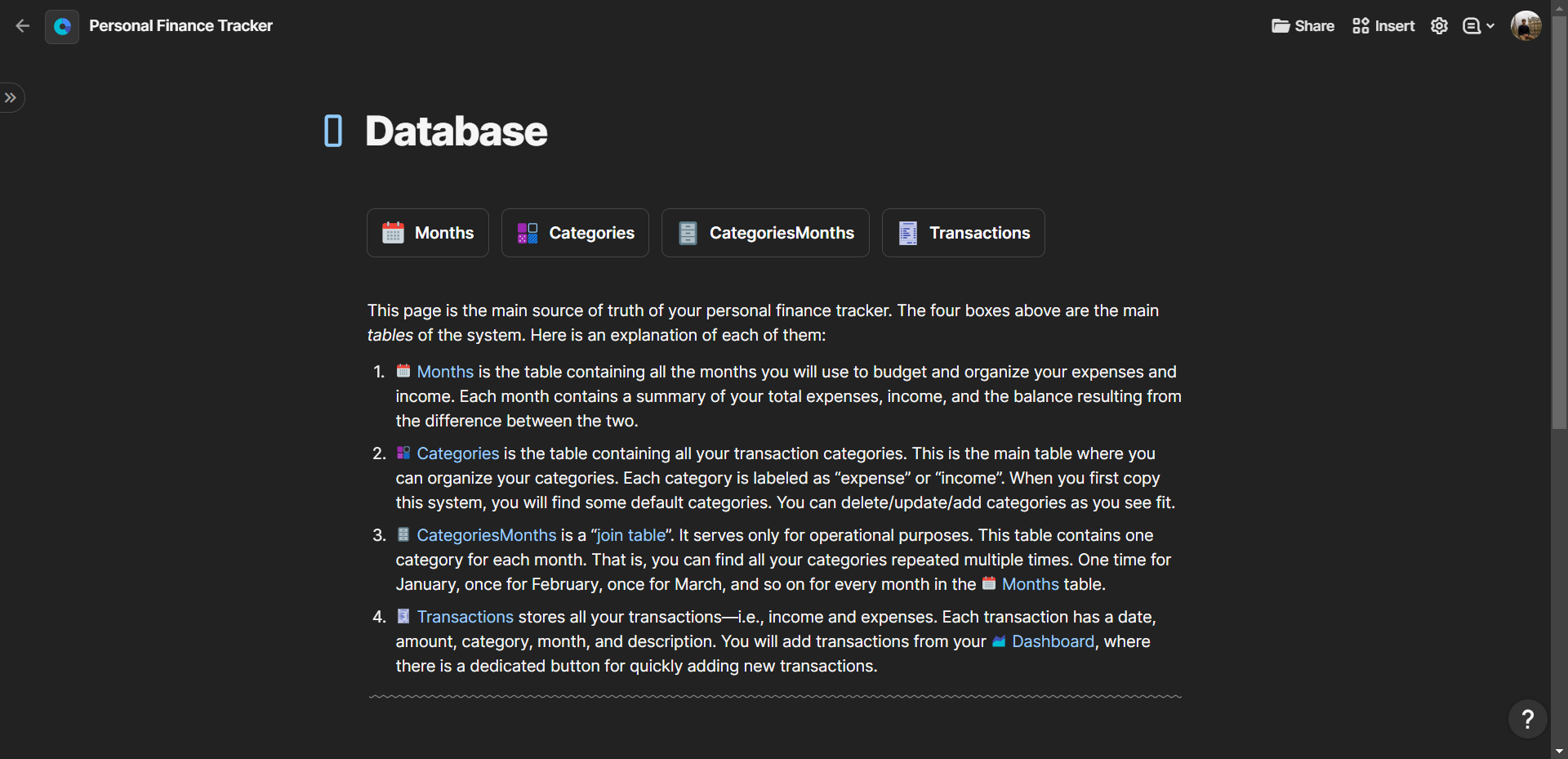

Those three workflows are facilitated by the use of four related tables that are at the very foundation of the entire infrastructure:

Months: the table containing all the months you will use to budget and organize your expenses and income. Each month contains a summary of your total expenses, income, and the balance resulting from the difference between the two.

Categories: the table containing all your transaction categories. This is the main table where you can organize your categories. Each category is labeled as “expense” or “income”. When you first copy this system, you will find some default categories. You can delete/update/add categories as you see fit.

CategoriesMonths: a “join table”. It serves only for operational purposes. This table contains one category for each month. That is, you can find all your categories repeated multiple times. One time for January, once for February, once for March, and so on for every month in the Months table.

Transactions: the table that ****stores all your transactions—i.e., income and expenses. Each transaction has a date, amount, category, month, and description. You will add transactions from your Dashboard, where there is a dedicated button for quickly adding new transactions.

We use different views of those tables to generate visual dashboards with summaries of all the data by months, quarter, and year. Everything is automated, besides the data entry of transactions. If you have bank accounts in the US or Canada, you could also automate the data entry of transactions using a dedicated Coda Pack: Finta (or find other finance-related Coda packs here). To get an overview of the whole system and its workflow, you can watch the video below.

Template

Resources

I Will Teach You To Be Rich Podcast - Ramith Sethi

The Psychology of Money - Morgan Housel

Similar Content

Affiliate Links

Get one free month on the pro plan in Make (automation software)

Get 20% off any Centered subscription (deep work sessions tracker with AI coaches) by using the discount code

SIMONE20here.Automate your processes with AI: https://get.bitskout.com/s3e5wkwuks8h