Strategic Management: The Systematic Approach to Innovation

The essence of strategy is choosing what not to do.

Crafting and carrying out effective strategies in the modern organizational environment is not an easy endeavor. This is because of the fast-paced business paradigm we are currently living in, and also due to the fact that there is an unprecedented amount of knowledge circulating, sometimes making it tough to choose what is essential for the organization at any given time. However, effective strategies require deciding what not to do just as much as what to do. This decision is driven by the culture and core competences of the organization. Author Greg McKeown would call this Essentialism applied to the business world. Professor Michael Porter has worked on defining strategic management and competitive advantage for decades, and developed strategic frameworks that have set the standard in the business world for more than 30 years. In this article we are analyzing exactly this: Michael Porter's frameworks of industry analysis and competitive strategy. We will dive into these topics by first introducing what a strategy is, to then break down the "5 Forces Model of industry analysis" and the "Competitive Strategy" framework by prof. Michael Porter. You can find resources to understand the topics more in depth at the end of the article. My role here is to spark interest and transfer some of the knowledge I had the privilege to get from a university course on Strategic Management (as well as reading books about this), since teaching what you learn to someone else may be one of the best ways to retain that information. I am no professor, researcher, or experienced businessman. But you may find this content of value, and expand on it from here, so that your curiosity has been fueled by this article, which is its primary objective.

What is a Strategy?

Image inspired by a design as presented by prof. Couturier Jerome (2021)

“Strategy is a set of coordinated, creative and sustainable actions (a plan) designed to overcome one or more core challenges that create value.”

While the word strategy is often attributed different meanings based on our own partial understanding of the world, its definition is based on two main concepts, as drs. Sola and Couturier point out in their book "Thinking Strategically" (2013): knowledge of the current state, and uncertainty about the future state. In between the present and the future, there are choices and decisions to be made. The strategic process is an iterative one. It begins from the aspirations of an organization: mission, vision, values. These are at the very core of any strategy. This is what author Simon Sinek talks about in his bestseller book Start With Why. If we do not know who we are, or what we are in the world for, then there is no solid foundation for an effective strategy. And our own "why" behind what we do must be revisited and can be varied based on what we truly believe at any given moment. Merely setting the organizational culture for the sake of devising a strategic plan may be a recipe for disaster, if you do not deeply believe in it. In the words of Couturier and Sola (2013): "strategy has to include all these elements: a long-term vision, a clear understanding of your current issues and opportunities, clear goals and a set of initiatives that will help you to achieve your goals and eventually reach your vision."

The end objective of a strategy is to create value for the outside world and stakeholders. Creating value, however, is only the tip of the iceberg. It is, one could argue, a by-product of carefully devising a step-by-step strategic plan which stays true to the organization's purpose. The concept of strategy is composed of 3 main parts (Sola & Couturier, 2013): identifying core challenges (this is done through situational analysis — see Porter's 5 Forces model); taking coordinated, creative, and deliberate action (after setting objectives, key results, and how to go about executing those); creating value as a result of appropriate strategy execution. In the business context, strategy is a multi-layered concept, which originates from a "corporate strategy" and feeds all the way to department-specific strategies passing through business unit strategies. The primary goal of every strategy is, whether clearly or conspicuously, generating competitive advantage for the organization when compared to the industry. Such a competitive advantage exists whenever the value created by an organization's strategy outperforms the average in the industry where the business operates. Competitive advantage translates to better-than-average profits. It stems from the tangible plans and actions of the organization, rather than being based on some possible future potential of the company.

What is the context in which a strategy is defined?

According to Michael Porter (1986), there are two axes based on which a strategy is defined: industry attractiveness and competitive positioning. These represent the practical foundation for conceptualizing strategies in the business realm. The two dimensions defining the context of strategies represent internal and external analysis, in order for organizations to carefully understand the whole environment they are operating in. Industry attractiveness refers to the external environment the business is embedded into. This is the whole breadth of stakeholders, and is researched in order to figure out how to compete successfully in the market. Industry attractiveness can be investigated through Porter's 5 Forces Framework. However, the industry, being "out there", externally to the corporation, is malleable and constantly varying. For this reason, organizations must also assess their competitive positioning, i.e. their key competences that make them stand out from the competition. This is a more internally-oriented examination, which can act as a powerful awareness-enhancing model for any business. As French philosopher Voltaire once put it: "One must cultivate one's own garden" (Voltaire, 1759). Understanding strengths and weaknesses of themselves, organizations can augment their self awareness and hence make more mindful decisions. These two frameworks are at the foundation of strategy development, right after the pivotal culture setting.

Besides the above aspects of strategic management, at the essence of strategy setting there lies strategic thinking (Sola & Couturier, 2013). Strategic thinking builds on a continuous learning mindset. Strategic thinking requires a capacity to reason in systems, use intuition at the right time, and balance logic with intuitive thinking. As Sola and Couturier postulate (2013), the development of strategic thinking takes place through questioning and observing the assumptions and the world around us, listening deeply and debating open-mindedly, reflecting on our learnings and acting based on new mental models acquired thanks to experiential inputs.

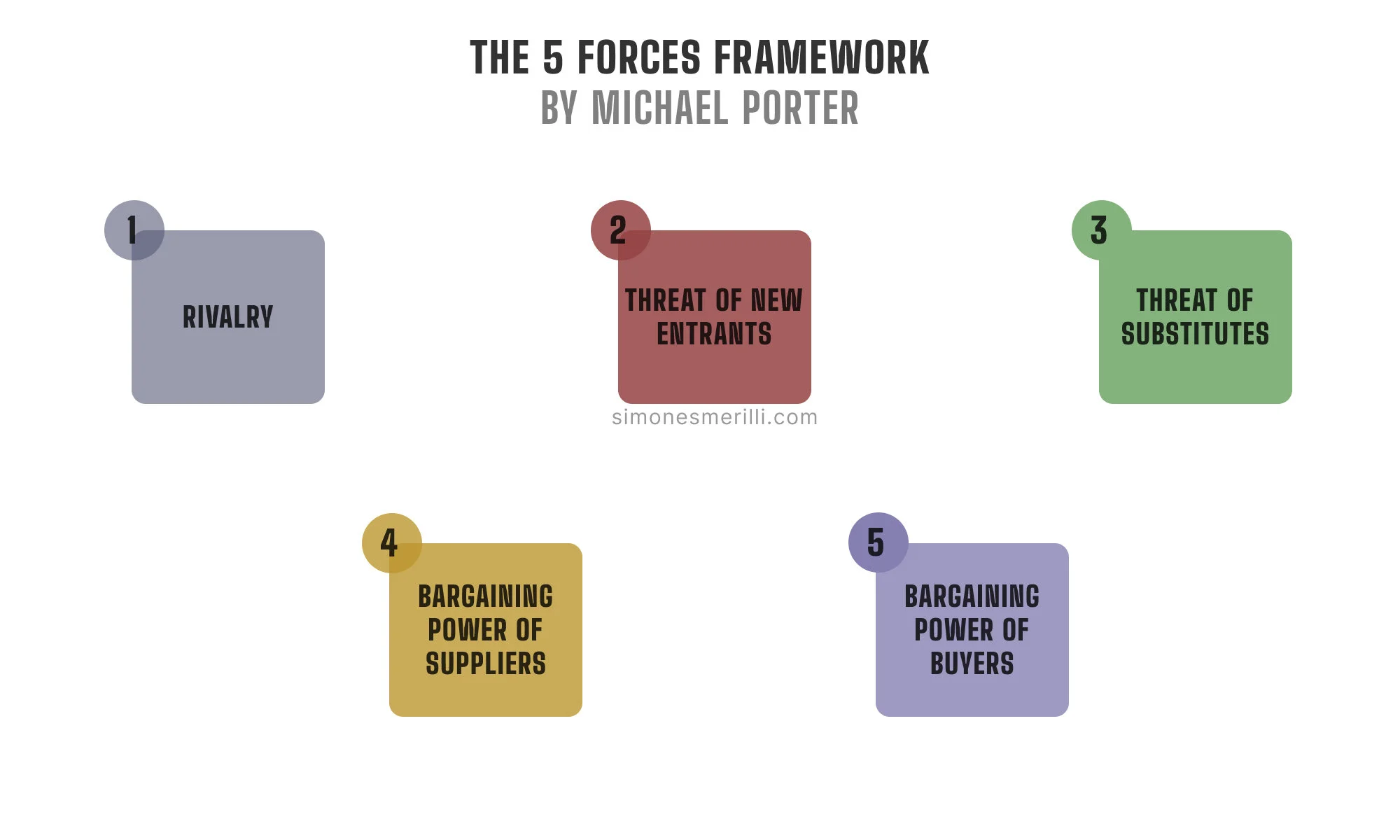

Porter's 5 forces framework of industry analysis

When it comes to analyzing the industry (external environment) and all its components, Porter's 5 Forces framework (1979) is probably the most widely utilized configuration. This model of analysis is composed of 5 factors to dissect:

Rivalry among existing competitors: how saturated the industry is (how many players there are)

Threat of new entrants: how easy it is for new businesses to enter the industry

Threat of substitutes: how likely (and easy) it is for buyers to switch between brands often

Bargaining power of buyers: how consumer behavior and preferences can dictate the prices and quality of products offered

Bargaining power of suppliers: the position of suppliers in setting strict prices on their own terms (the less suppliers there are, the higher bargaining power they have)

Some industries are fundamentally more attractive than others. However, most industries are not fixed. The 5 Forces model can also be used to observe how an industry may be changing in the upcoming future. If we analyze the pharmaceutical industry, we can notice that it scores positively in every one of the forces: the industry is incredibly difficult to enter (low threat of new entrants); there are only a few big players competing with each other (low rivalry); products are very specific and require deep intellectual property to be produced (low threat of substitutes); due to the few competitors in the industry, buyers do not have a high power to pick among products and prices (low bargaining power of buyers); suppliers of chemicals are numerous, hence not having much power to set fixed prices (low bargaining power of suppliers).

Some marketing variables are also key to the anatomy of an industry:

growth can be defined in a continuum between slow and rapid. In slow-growth industries, the name of the game is market share. This means that firms competing in a slow growth market are mainly focused on expanding as much as possible their share in the market. On the other hand, rapid-growth industries call for firms' efforts to be invested into keeping up with the industry, which requires significant attention and is, at the same time, a great opportunity to expand by merely keeping up with the industry growth.

cost fraction is the slice of buyers' expenditures represented by the industry and the company. Where the product sold by the industry in question is a small fraction of buyers’ costs, buyers are usually much less price sensitive compared to when the cost fraction is high.

output differentiation creates layers of protection for the company against competitors due to the fact that products that have unique characteristics attract a niche and loyal customer base. By contrast, when the product or service is perceived as a commodity, buyers choices are based on price and service, and pressures for strong price and service competition result. A related factor influencing rivalry is switching costs. Switching costs are one-time costs of switching brands, or switching from one competitor’s product to another. If these switching costs are high, then competitors must offer a major improvement in cost or performance in order for the buyer to switch.

distribution is a continuum where the extremities are "open" and "saturated". A barrier to entry can be created by the new entrant’s need to secure distribution for its product. To the extent that logical distribution channels for the product have already been served by established firms, the new firm must persuade the channels to accept its product through price breaks, cooperative advertising allowances, and similar initiatives, which reduce profits. Sometimes this barrier to entry is so high that, to surmount it, a new firm must create an entirely new distribution channel in order to get into the industry.

Finally, threats can come from outside the value system (threats of entrants and threats of substitutes). The main types of threats include:

integration threat: if buyers either are partially integrated or pose a strong threat of backward integration, they are in a position to demand bargaining concessions. They can engage in the practice of tapered integration, or producing some of their needs for a given component in-house and purchasing the rest from outside suppliers. The supplier group poses a credible threat of forward integration. This provides a check against the industry’s ability to improve the terms on which it purchases.

entry deterring price: if the current price level is higher than the entry deterring price, entrants will forecast above-average profits from entry, and entry will occur. The entry deterring price is a cost-benefit analysis of entering an industry.

substitutes price performance: All firms in an industry are competing, in a broad sense, with industries producing substitute products. Substitutes limit the potential of an industry by placing a ceiling on the prices firms can charge. The more attractive the price-performance tradeoff offered by substitutes, the lower the chances of increasing profits.

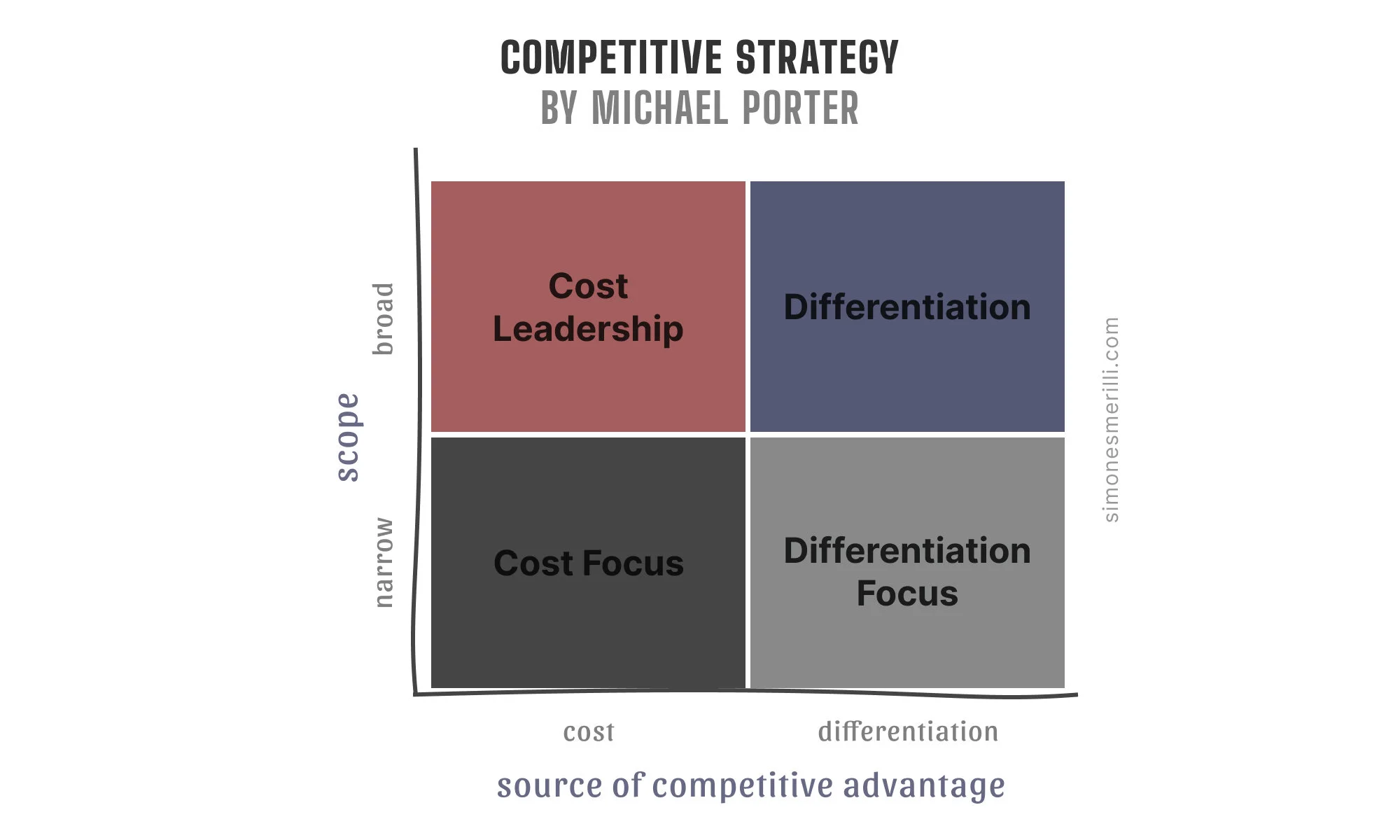

Competitive strategy & Porter's framework

When it comes to examining the internal situation of the organization, every business strives to maximize its competitive advantage. Competitive advantage is a favorable position of the company in the industry it operates in, which naturally translates into higher profits. According to Michael Porter (1986): "Competitive Advantage is the result of a strategy capable of helping a firm maintain and sustain a favorable market position. This position is translated into higher profits compared to those obtained by competitors operating in the same industry" (Porter, 1986). In order to measure the internal situation of any corporation, Porter developed the Competitive Strategy framework, which aims at finding and exploiting the true potential of the company, and deciding a clear competitive strategy that takes a defined stance in the market. In particular, according to Porter's framework, competitive advantage can take the form of cost leadership (Relative price = Average and Relative cost < Average) or differentiation (Relative price > Average and Relative cost = Average). Every business needs to decide its way of proposing value to stakeholders. A cost leadership strategy seeks competitive advantage from low costs and high volume. Differentiation is a high-level strategy that focuses on maximizing the quality of the offer, sold at premium prices. A key idea of this strategic framework is that you do not want to be in the middle, trying to serve every type of consumer. Taking a clear stance and investing on it seems to be the best choice. Choosing which strategy to undertake does not merely depend on internal factors, but also on the value chain and surrounding environment an organization is part of. The environment around the firm is composed of all its stakeholders, beginning from suppliers all the way to final consumers. In this approach, there are 4 possible resulting strategies:

Broad Cost Leadership Strategy: this is a positioning strategy which aims at offering products at low costs to a wide audience in order to gain competitive advantage. Some key characteristics here are: profit margins are lower, consistency is needed over time, so that consumers understand where the product stands among the various options in the market.

Focus Cost leadership Strategy: this is a positioning strategy in which the company aims at providing products at low costs to a specific, unusual customer base. Organizations choosing this positioning tend to only focus on a small amount of products or services, in order not to broaden their strategy and end up in the broad cost leadership positioning. In addition, they carefully study the competition, in order to keep having a cost leadership advantage.

Broad Differentiation Strategy: at the core of this positioning strategy is the concept of creating value for the customer; value which must be perceived by the buyer and which must be communicated promptly, in order to make people aware of the quality of the product or service. What's more, differentiation is costly. However, this doesn't mean that companies in this dimension spend carelessly. Quite the opposite, in fact. They pay close attention to extra costs and try to minimize them as much as possible, in order to keep an extra edge from competitors. Finally, differentiators are a moving target: they are constantly in flow and ready to adapt to the industry in order to keep their advantage.

Focus Differentiation Strategy: the fact that companies adopting this strategy bet on a very small niche of the market with greater needs than the rest is the source of competitive advantage. At the same time, this can also be a curse for the company with a focused differentiation strategy, as if it doesn't serve the niche properly or their products don't live up to their standards, they are out of the industry right away. So, delivering primal value for the consumer is key in the focus differentiation strategy. As is communicating that value and making sure to stay laser-focused on making the highest quality products possible for the niche market targeted.

Sola and Couturier (2013) postulate that there are three main sources of competitive advantage:

structural, i.e. those embedded in the organizations and unique to them (e.g. proprietary advanced technology, strong brand name and perception)

execution, i.e. there is distinctiveness in the day-to-day execution of activities by the company, which outperforms competitors thanks to its efficient business system

insight/forecast, i.e. "scientific or technical expertise, creativity or the ability to recognise patterns and trends" (Sola and Couturier, 2013).

““You have a strategy until you get punched in the nose””

I also write a weekly newsletter. If you want to stay up to date and receive essential life ideas, once a week, consider signing up here.

RESOURCES

Porter, M. E. Competitive Strategy: Techniques for Analyzing Industries and Competitors. New York: Free Press, 1980. (Republished with a new introduction, 1998.)

How Competitive Forces Shape Strategy | Michael Porter

How to Think Strategically: Your Roadmap to Innovation and Results | Sola & Couturier, 2013

SIMILAR POSTS